|

|

|

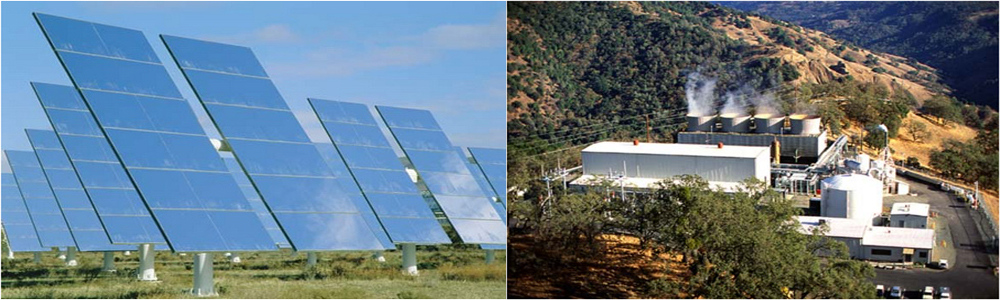

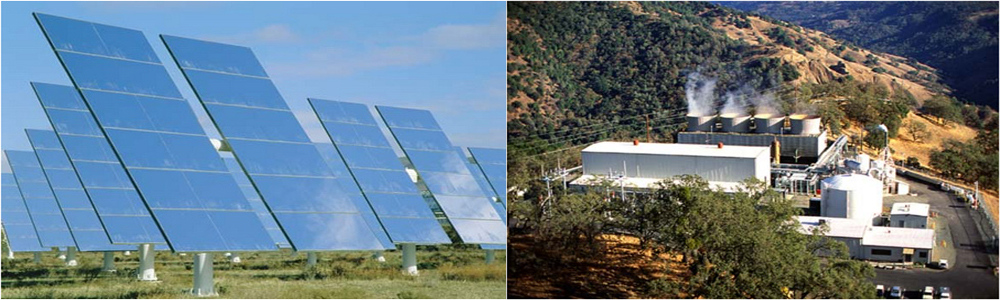

Despite an abundance of renewable energy sources, the countries of Latin America and the Caribbean are still in the early stages of developing “green” sources of power. Harnessing water, sunlight, wind, and the earth’s heat allows countries to transition away from carbon based energy production in favor of renewable sources of energy. The region is undergoing a dramatic period of economic growth, enabled by access to affordable, clean and reliable electricity. For BRIC Advisory, renewable energy is a focus area. We work closely with sponsors throughout the development process, managing the complexities of project finance transactions to ensure financial close. With its unique mandate of arranging bank loans provided by development institutions, BRIC Advisory provides clients the advantage of ensuring their renewable energy projects are properly structured to receive priority attention. Sponsors of wind, solar, small hydro, geothermal and ethanol projects all count BRIC Advisory as a trusted advisor, working on their behalf to arrange bank debt financing to fund their clean energy projects. Within development institutions, lending to renewable energy projects is part of a broader strategy of mitigating climate change. As a consequence, capital earmarked for the energy sector flows in greater abundance to sustainable energy projects, such as wind, solar and geothermal, instead of projects relying on coal or fuel oil. In terms of dollars invested and number of deals completed, nearly 70% of commitments to the power sector by development institutions are made to clean energy projects. Moreover, providing loans to improve access to electricity, upgrade ageing distribution systems and introduce affordable and reliable electricity service for homes and businesses speed economic development. As an exclusive arranger of private sector loans originated by leading development institutions, BRIC Advisory is uniquely positioned to assist sponsors of clean energy projects access capital for projects. BRIC Advisory has cultivated long term relationships with multilateral banks, national development banks and export credit agencies that provided bank debt to fund the following projects:

|